Managing BESS is complex, but it doesn't have to be — Here's a few tips from our SMEs

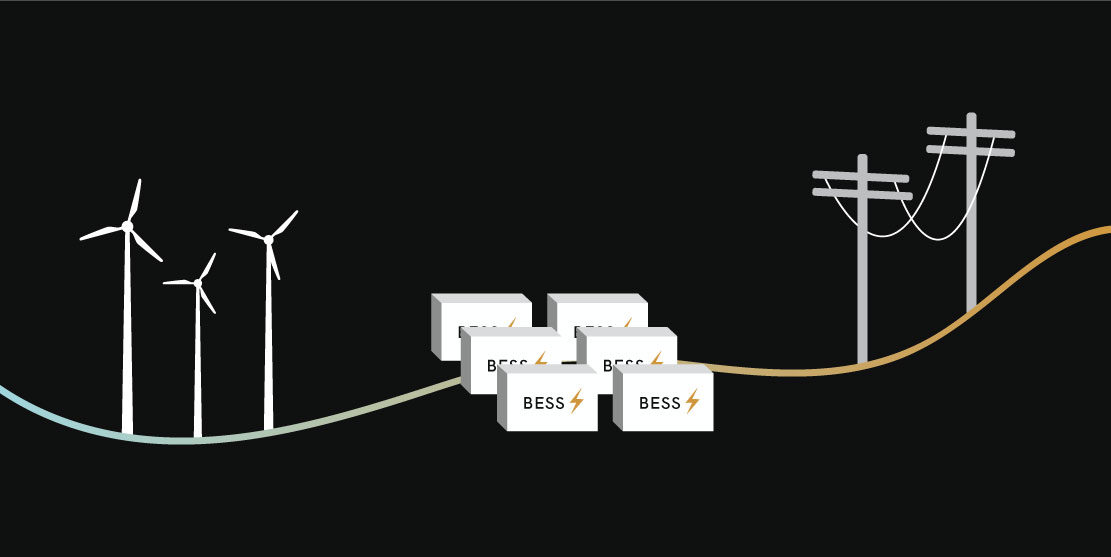

The trendiest and latest transformative technology for renewable energy is Battery Energy Storage System (BESS). But as with any new endeavor, they can be difficult to manage—particularly for maximizing scheduled events without utility fines. We compiled a list of the KPIs and use cases for renewable energy to manage energy demand with a BESS.

Let's start with cost effectiveness. While management can be complex, BESS investment can be cost-effective if you consider three value indicators:

-

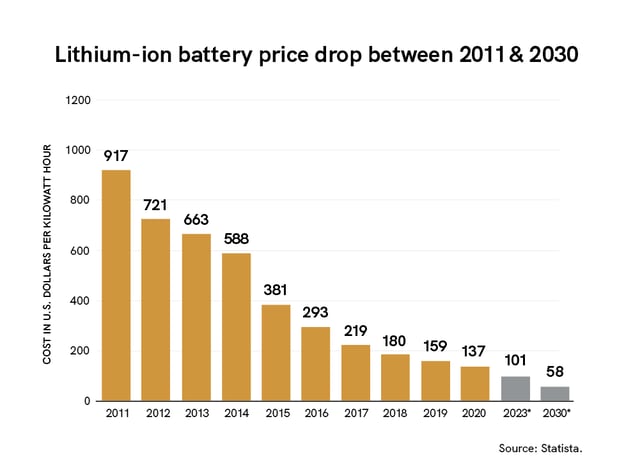

The cost of lithium-ion batteries has gone down significantly (refer to the chart below). This makes the ROI for energy storage advantageous.

-

Got over capacity? BESS might be your solution to energy abundance! Thanks to incentives, most projects are designed and commissioned with more capacity than needed to meet production KPIs. Recent market analyses have proven overproduction is neither cost-effective nor environmentally friendly, which hinders the environmental movement.

-

Being able to store energy via BESS evolves renewables into a more traditional energy model where energy can be used to supply power to combined asset(s) and at varying times—not just peak demand. The new model of combining traditional renewable assets with BESS presents a new revenue opportunity and paves the way for continued participation in the market.

Lithium-ion battery price drop between 2011 and 2030. Source: Statista.

Managing BESS assets is a complex endeavor. The process requires managing battery life, health and availability of the combined asset(s), and energy arbitrage, while optimizing demand charge management, which is fundamental to capitalize on scheduled market events. It’s a literal balancing act that is hard to get right without the help of automation. If stand alone or combined BESS is poorly managed, missed opportunities and penalties can negate the investment.

The Difficulty of Managing BESS to Maximize Market Events

Renewable energy owners and operators are investing in BESS to help balance loads between on-peak and off-peak times. Electricity demands vary depending on the day, time, season, and local tariffs. Tariffs meaning the higher demand, the higher the electricity cost and vice versa—pricing is lowered during off-peak hours. By storing energy when the demand is low and discharging it in peak periods, battery storage solutions improve demand charge management. So what’s so difficult about that?

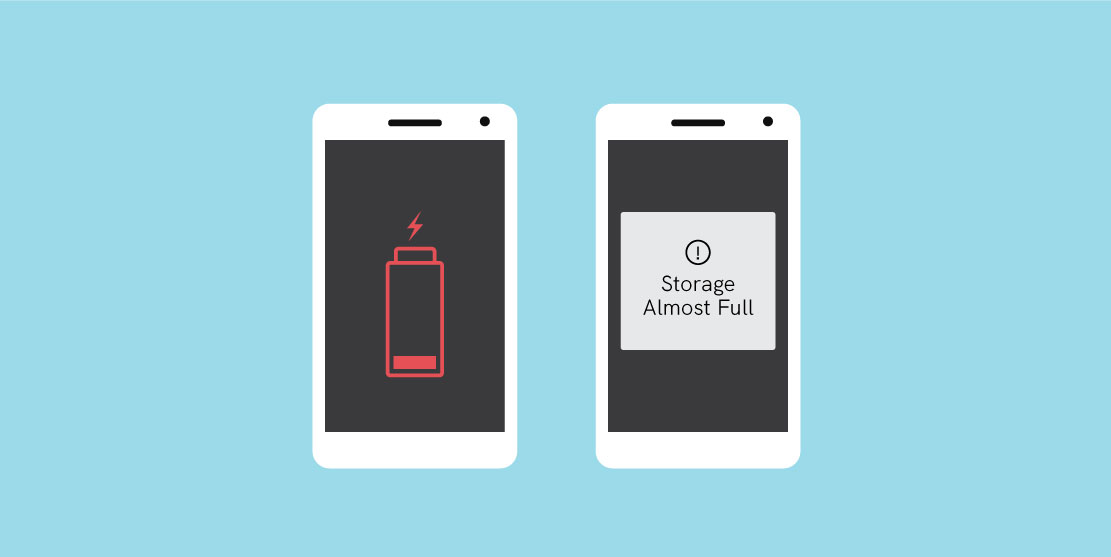

Let’s consider the example of your cell phone. Demand Charge Management for market events is similar to how you manage the charge and capacity of your cell phone. We’ve all been told that leaving your cell phone plugged in and continuing charging after it reaches 100% leads to faster degradation.

The golden rule is to keep your battery charged somewhere between 30% and 90% most of the time. Pushing in the last charge from 80-100% or letting it get below 20% causes a lithium-ion batteries to degrade faster. This is easier said than done. So what happens when you need to record your child’s recital? Have you thought ahead to get your phone battery to 80% charge and remove any previous videos to ensure you have space and power for the recording? The recital won’t wait for you to take these steps.

Similarly, a scheduled market event requires you to have your BESS asset(s) appropriately charged for the event and ready to discharge for the event's duration. Timing is critical. An event might happen during a peak time for energy usage and if you don’t have enough energy stored, you might miss the market opportunity. Partial participation can end up costing you.

Market participation requires your commitment to demand charge management, thus supplying energy during event duration. As we know, consumers aren’t great at managing the battery life of cell phones. Asset Managers are realizing that managing BESS is difficult to do without the help of KPIs and automation.

The Data You Need to Manage Your BESS Effectively

Most BESS systems don’t come with advanced software and only generate SCADA data on basic info such as power and state of charge (SOC). That data can be ingested into any asset management system, but it isn’t very useful without a SaaS platform that provides actionable insights for proactive Demand Charge Management.

If a market event is 4 hours, you need to discharge your system for the full duration of the event. In order to do this you need to know how much capacity you have and how much you need to discharge for the event's duration. This boils down to three main performance metrics that are needed to maximize scheduled events: utility usage/availability, charge/discharge rates, and the optimal demand.

The Top 3 KPIs You Need to Manage Scheduled Events

- Utility usage/availability - this information will allow you to dispatch power to the grid in response to market events signaled by the utility. This can earn additional payment for capacity services and program participation.

- Charge and discharge rate - understanding the state of charge (SOC) as well as the rate of charge/ discharge (C-rates) can enable frequency regulation. The battery can inject or absorb power to follow a regulation where there is payment arranged for this regulation service.

- Optimal demand - calculated availability relative to the market event plus combined asset availability KPIs. With this information you can ensure your BESS asset(s) are optimized to dispatch power to the grid in response to market events. This can earn additional payment for capacity services and program participation.

Having advanced analytics and dashboard(s) with this information is critical to the holistic day-to-day management of your projects. Schedule a demo and let's talk about our BESS advanced analytics toolkits!